Health Savings Accounts (HSA) are specific accounts for healthcare savings and expenses. They have multiple benefits like tax advantages, healthcare savings, and potential retirement benefits.

Let’s take a quick dive into Health Savings Accounts (HSAs or HAS if your autocorrect is on!).

- What are they?

- Why should you care?

- What are some of the nitty-gritty details?

- Short story time

What is a HSA?

Think of a HSA as a special savings or investment account tailor-made for healthcare expenses. They are a fantastic way to manage medical costs if you have a high-deductible health plan (HDHP). Unfortunately, you have to qualify for a health savings account by having a high-deductible health plan. The determination for a high-deductible health plan is dependent on a few factors, so make sure to verify your health plan meets the definition. Usually, a HDHP means you are paying lower monthly premiums but would have to tackle higher deductibles compared to the standard health insurance deals. Essentially, you are taking on more upfront costs in exchange for the sweet, sweet savings on your premiums.

Why should you care?

Let’s rephrase this: you should care if you’re eligible, and here are a few reasons why.

First, tax perks.

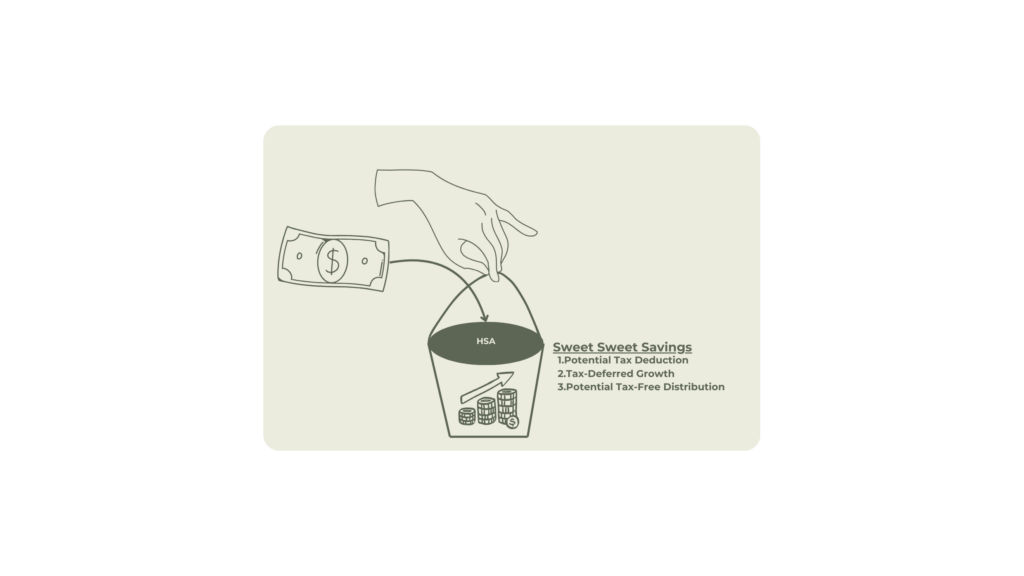

Do I even have to say more? HSAs come with some serious tax benefits. When you save money into your HSA, it’s like snagging a tax break because typically your contributions are tax-deductible. That means you can trim your taxable income by the amount you put into your HSA. Don’t get overly excited, as there are limits to how much you can add! The limits are dependent on multiple factors, so we would be able to help determine how much you can contribute.

Second, tax perks.

Yes, it needed to be said. When you contribute to your Health Savings Account and your money is invested in an asset, any interest or investment earnings you rack up are tax-free. When we work with clients that have had HSAs prior to our advice, they have had all their contributions sitting in cash and not earning any additional income. They missed a big opportunity. We will work with you to determine what that looks like in your situation, with lots to consider, like big medical expenses coming up, risk tolerance, retirement, the current emergency fund balance, etc.

Third, tax perks.

Promise, this is the last time! The best part is that you can use your HSA funds for all sorts of medical needs, like doctor visits, prescriptions, dental care, vision checkups, and more. The tax cherry on top? When you use your Health Savings Account for qualified medical expenses, the distributions are tax free!

So essentially, the HSA is a tax jackpot three times over!

What are some of the nitty-gritty details?

Hold on, there are some details you need to consider before running out and starting your own HSA.

Eligibility.

Remember, you have to qualify to open and fund a Health Savings Account. One factor is that you need to be on a high-deductible health plan (HDHP). You cannot have any other healthcare coverage except what is permitted. If you are enrolled in Medicare or are claimed on someone else’s tax return you are not eligible. You also need to have coverage for the time period you are contributing (these rules are complex, so ask us).

Contributions.

They are limited depending on eligibility, type of HDHP coverage, your age, your employer contributions, and when you became eligible and when eligibility ceases. If you are more career experienced, i.e., 55+, you do have additional catch up contributions. Contributions must be in cash, meaning you cannot contribute stock or property (sorry, no real estate for you real estate lovers). You have a few options on how to contribute, the easiest is through your employers payroll services. You can also contribute on your own without it being through your employer. Contributions can be made throughout the year and up until the tax filing date for that calendar year. Generally, you can claim contributions you make as a deduction (not employer contributions).

Distributions.

Generally, paid medical expenses that have not been reimbursed are qualified distributions from your HSA. If you paid for the expense, you would take a distribution to reimburse yourself. You can receive tax-free distributions from your HSA for qualified medical expenses that were incurred after you established your HSA, not for expenses incurred before.

If you take distributions from your HSA for any other reason, you will be subject to income tax and may be subject to an additional 20% tax—avoid at all costs.

Keep all records to show that a distribution was exclusively made for a qualified medical expense. Keep these records with the tax return associated with the year the distribution took place. If you’re one of the lucky ones and don’t end up needing your HSA for healthcare, you can take distributions starting at 65 without the penalty; however, income tax will still apply similarly to a traditional IRA distribution.

Typically distributions cannot be used for insurance premiums as they do not qualify. However, there are a few exceptions to this rule. Qualified long-term care coverage, COBRA, and Medicare premiums are exceptions and are considered qualified distributions. Keep in mind that Medicare premiums qualify; however, supplemental Medicare (Medigap policies) are not qualified distributions.

Now who has to have the expense for it to be qualified? Another great concept to understand. Qualified medical expenses can be paid on behalf of the HSA owner, spouse, and/or beneficiaries. So if you the Health Savings Account owner can pay for your spouse’s expenses and they will be a qualified expense even if they are not covered under the high deductible health plan.

One more important thing to remember, if you were reimbursed for that expense or deducted that expense it is no longer a qualified medical expense! No double dipping!

Investing.

Typically, you can invest your Health Savings Account dollars; however, it depends on your Health Savings Account provider. Healthcare will most likely be one of the bigger expenses you’ll have throughout your life, so investing these dollars could make sense to achieve your goals.

Portability.

Your Health Savings Account is all yours. It is not tied to your job or health care plan. So, even if you switch jobs or insurance plans, you keep your HSA.

Flexibility.

It is not a use-it-or-lose-it account. If you don’t use any of the money by the end of the year, that’s ok; your funds are yours and can roll over from year to year. So stashing this account and letting it ride until a big expense or retirement is a solid, smart plan.

Death of HSA owner.

There are some very unique rules when it comes to the death of a Health Savings Account owner. You are the HSA owner and you pass, your spouse is your beneficiary- the spouse will inherit the HSA and the account will stay as a HSA. No tax occurs (until they take out money).

Now if you have a non-spouse beneficiary elected, when they inherit the HSA it will NO longer stay as a Health Savings Account. Meaning the account will be liquidated as a full market value taxable event. It is taxable to the non-spouse beneficiary-ouch! If the HSA is inherited by a Revocable Trust /Estate the HSA is again liquidated (it does not stay a HSA) and the HSA owner is taxed on their final tax return for the full market value of the account-double ouch! You can elect a charitable organization and it would not be taxable to that organization.

You need to be very mindful of who you elect as a beneficiary.

Short story time.

Yogi is a small business owner, he came to us wanting to make sure he was tracking well on his financial goal of a work optional lifestyle before age 50. This was his 12th year in business and had been very successful the last few years with excess cash to save. After looking at his tax return and getting information on his healthcare plan it was obvious he had a HDHP and was eligible for a health savings account. Unfortunately, he had never been advised to open a HSA and of course never have heard of that type of account. What a huge opportunity we were able to uncover and now he sleeps better knowing he is starting to rack up those smart healthcare monies!